can you ever owe money on stocks reddit

You could short a stock and long a call to cover the short position should things go against you. However you may not receive all of your money back ifwhen you sell.

How To Use Beta To Evaluate A Stock S Risk

Lets take a look at the two possible situations when this can happen.

. Margin borrowing available at most brokerages allows investors to borrow money to buy stock. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. If the stocks price dropped to 0 you would owe the lender nothing and your profit would be 5000 or 100.

It is possible but the dealership is simply going to add the remainder of the loan to the price of your new car. If not the dealership may pass that fee on to you. Answer 1 of 7.

Just an idea but there are many ways to accomplish what you want. Yes you can lose any amount of money invested in stocks. To get back to the historical average ratio of 075 and assuming stable earnings value stocks would have to rise by about 30 per cent or growth stocks would have to fall by over 20 per cent or some combination of both.

A little mean reversion here would mean a lot of outperformance for value. Even though the value of a stock can never go below zero it is possible to lose more than what you invested in the stock market and end up with a debt. Yes if you engage in margin trading you can be technically in debt.

My own view it is unadviseble to borrow for other than appreciating assets within an appropriate investment term. If your stocks bonds mutual funds ETFs or other securities lose value you wont normally owe money to your brokerage. Every morning at his old hedge fund CNBCs Jim Cramer would spend a few hours going over the mistakes.

Its not a good idea to trade in a car when you still owe money on the loan you purchased to buy that car. The investing app is a favorite among everyday traders who congregate in online forums like Reddits rWallStreetBets and has surpassed 18 million active users since its launch in 2013. It really depends on whether youre buying stocks on a margin loan or with cash.

Updated September 11 2021. The Silicon Valley darling which grew its following amid an investing surge during the COVID-19. If however the stock price went.

Ad Things are changing fast in the stock market but were staying focused on the future. The ratio is 057. Check out these 3 market-beating stocks.

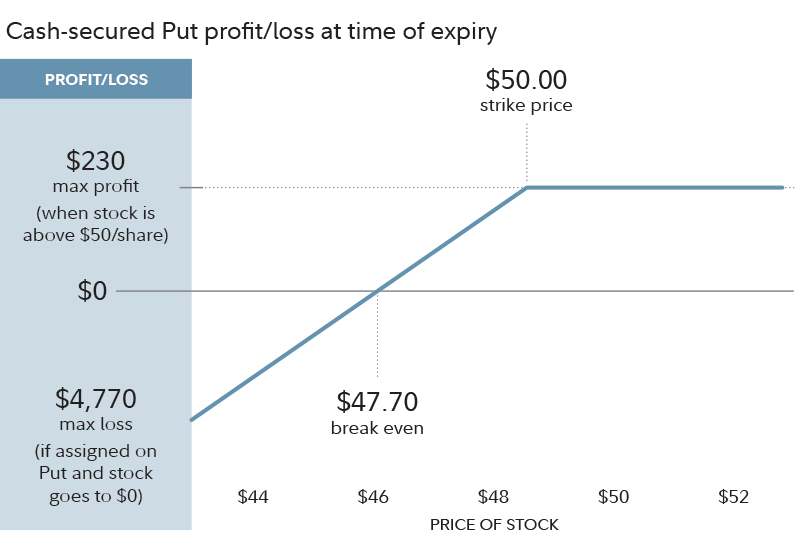

While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. Selling Stocks on a Margin. This can happen when a stock is declining in value as well as when it is appreciating in value.

Make sure your loan allows you to pay it off early. Too many stocks and too little cash can set you up for failure. A company can lose all its value which will likely translate into a declining stock price.

Lets get started today. If you are at all interested in investing youve almost certainly heard of Robinhood. If a stock drops to zero you can lose all the money youve invested.

Hopefully your broker wouldnt sign off on you trading options at that level of approval. You may owe money or shares which is essentially the same in practice. That would hedge some of your risk associated with shorting.

Stock prices also fluctuate depending on the supply and demand of the stock. Penny stocks come with high risks and the potential for above-average returns and investing in them requires care and caution. Mad Money with Jim Cramer.

Ad Were all about helping you get more from your money.

How Gamestop Found Itself At The Center Of A Groundbreaking Battle Between Wall Street And Small Investors Stock Markets The Guardian

Gme Short Squeeze Wallstreetbets Vs Hedge Funds Gemini

Do You Think It S Possible Amc Stock Will Really Hit 100 000 Quora

How Gamestop Found Itself At The Center Of A Groundbreaking Battle Between Wall Street And Small Investors Stock Markets The Guardian

Why Revlon Stock Is Trending After Filing Chapter 11 Bankruptcy Seeking Alpha

Gamestop Amc Stocks Surge As Reddit Forum Takes On Wall Street The Washington Post

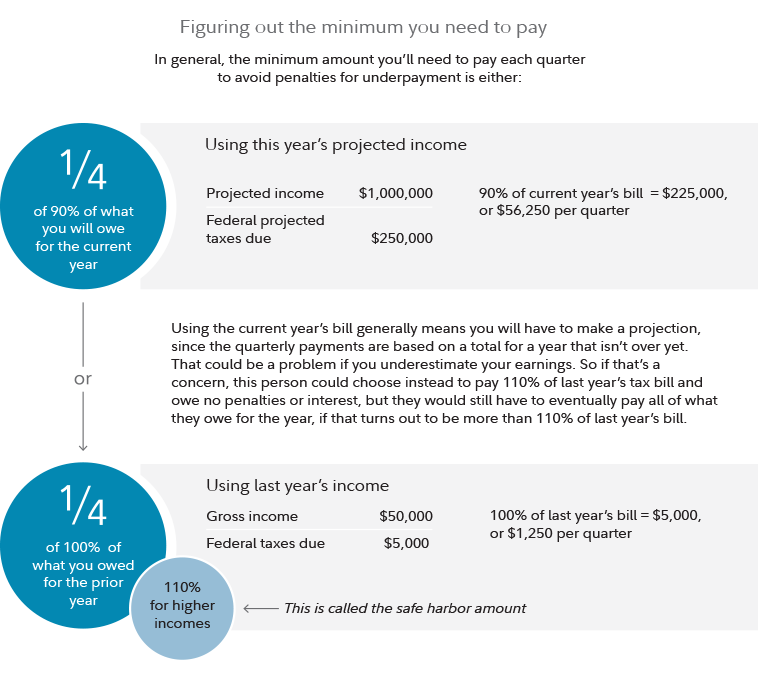

Taxes And Small Business Taxes And Freelancers Fidelity

How Gamestop Found Itself At The Center Of A Groundbreaking Battle Between Wall Street And Small Investors Stock Markets The Guardian

Do You Think It S Possible Amc Stock Will Really Hit 100 000 Quora

How To Read Your Brokerage 1099 Tax Form Youtube

How Gamestop Found Itself At The Center Of A Groundbreaking Battle Between Wall Street And Small Investors Stock Markets The Guardian

How Gamestop Found Itself At The Center Of A Groundbreaking Battle Between Wall Street And Small Investors Stock Markets The Guardian

How Gamestop Found Itself At The Center Of A Groundbreaking Battle Between Wall Street And Small Investors Stock Markets The Guardian

As Internet Frenzy Drives Its Stock Price Amc Warns Investors About The Dangers Of Buying In The Washington Post

How To Use Beta To Evaluate A Stock S Risk